Passive Investing: 6 Advantages to the Hands-Off Approach

Updated: 2024-03-28 21:24:18

Tier 5 and 6 members are subject to limits on the amount of overtime that can be included in their pension. You can earn overtime pay beyond the overtime limit, but it won’t be factored into your pension calculation. And you don’t pay member contributions on overtime pay that is above the limit. Tier 5 Overtime Limits The overtime […]

Tier 5 and 6 members are subject to limits on the amount of overtime that can be included in their pension. You can earn overtime pay beyond the overtime limit, but it won’t be factored into your pension calculation. And you don’t pay member contributions on overtime pay that is above the limit. Tier 5 Overtime Limits The overtime […] , About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page A Short History of the 60 40 Portfolio , Ep 341Â Posted by Benjamin Brandt Podcast 0 Due to last year’s poor market returns , youâ ve probably seen the headlines that the 60 40 portfolio is dead . But is that really the case This weekâ s retirement headline explores the history of this classic retirement investment strategy . After we tackle the headlines , Bret and I team up to consider the best places to move in retirement . Listen in to hear where not to . move Outline of This Episode 1:52 A history of the 60 40 portfolio 8:09 Why I like 60 40 15:10 Where should retirees consider moving to for a great retirement

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page A Short History of the 60 40 Portfolio , Ep 341Â Posted by Benjamin Brandt Podcast 0 Due to last year’s poor market returns , youâ ve probably seen the headlines that the 60 40 portfolio is dead . But is that really the case This weekâ s retirement headline explores the history of this classic retirement investment strategy . After we tackle the headlines , Bret and I team up to consider the best places to move in retirement . Listen in to hear where not to . move Outline of This Episode 1:52 A history of the 60 40 portfolio 8:09 Why I like 60 40 15:10 Where should retirees consider moving to for a great retirement The easiest way to become a millionaire is to max out your 401k contributions every year. It’s a lot of money to put away but trust me. Your 401k will ... Read more

The post Should I Stop Contributing to My 401k? appeared first on Retire by 40.

The easiest way to become a millionaire is to max out your 401k contributions every year. It’s a lot of money to put away but trust me. Your 401k will ... Read more

The post Should I Stop Contributing to My 401k? appeared first on Retire by 40.

Planning on taking out a NYSLRS loan? Applying through Retirement Online is fast and convenient. Eligibility for a NYSLRS loan is based on your tier. Generally, you’ll need to be on the payroll of a participating employer, have at least one year of service and have sufficient contributions in your account. (Note: Retirees are not […]

Planning on taking out a NYSLRS loan? Applying through Retirement Online is fast and convenient. Eligibility for a NYSLRS loan is based on your tier. Generally, you’ll need to be on the payroll of a participating employer, have at least one year of service and have sufficient contributions in your account. (Note: Retirees are not […] NYSLRS retirement plans provide death benefits for beneficiaries of eligible members who die before retiring. If you are retired, your beneficiaries may be entitled to a post-retirement death benefit. It’s important to name beneficiaries and review them periodically. Life circumstances sometimes change, and the beneficiary you named before might not be the one you would […]

NYSLRS retirement plans provide death benefits for beneficiaries of eligible members who die before retiring. If you are retired, your beneficiaries may be entitled to a post-retirement death benefit. It’s important to name beneficiaries and review them periodically. Life circumstances sometimes change, and the beneficiary you named before might not be the one you would […] , About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page 8 Ways to Become Poor in Retirement , Ep 340 Posted by Benjamin Brandt Podcast 0 There are many ways that could threaten your financial security in retirement . Knowing the common issues can ensure that you donâ t fall into the . traps Todayâ s financial headline comes from Yahoo Finance and is called 8 Ways Baby Boomers Become Poor in Retirement Listen in to learn what they are so that you donâ t drive yourself into the . poorhouse Outline of This Episode 1:22 8 ways to become poor in retirement 10:58 How can we determine the biases in an advisor 8 ways to ruin your financial security in retirement Carrying a

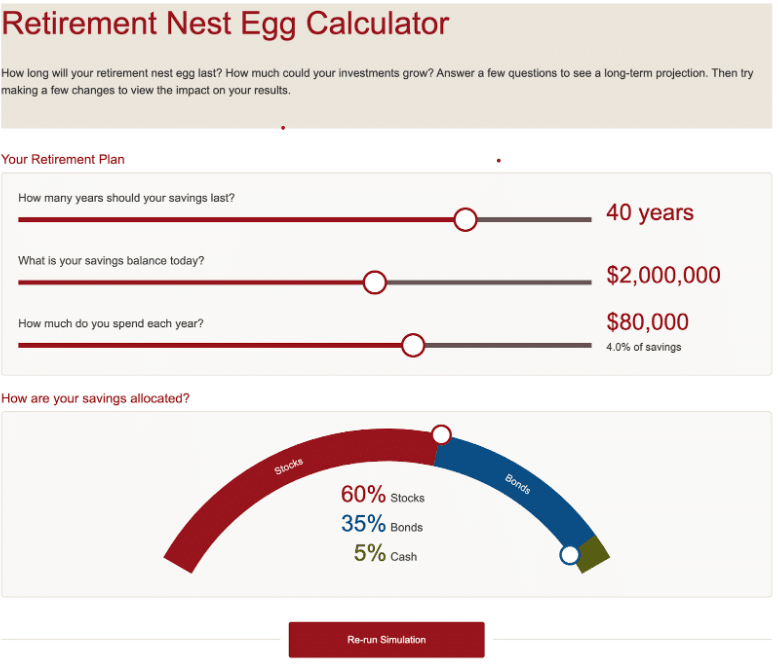

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page 8 Ways to Become Poor in Retirement , Ep 340 Posted by Benjamin Brandt Podcast 0 There are many ways that could threaten your financial security in retirement . Knowing the common issues can ensure that you donâ t fall into the . traps Todayâ s financial headline comes from Yahoo Finance and is called 8 Ways Baby Boomers Become Poor in Retirement Listen in to learn what they are so that you donâ t drive yourself into the . poorhouse Outline of This Episode 1:22 8 ways to become poor in retirement 10:58 How can we determine the biases in an advisor 8 ways to ruin your financial security in retirement Carrying a I was recently invited to speak at the EconoMe conference about the process of creating more accurate retirement projections. In preparing for my talk, I reviewed Darrow’s extensive work on retirement calculators on this blog. I want to expand upon a concept he’s written about: calculator fidelity. Understanding it is the first step in choosing...

The post The First Step to Choosing the Right Retirement Calculator appeared first on Can I Retire Yet?.

I was recently invited to speak at the EconoMe conference about the process of creating more accurate retirement projections. In preparing for my talk, I reviewed Darrow’s extensive work on retirement calculators on this blog. I want to expand upon a concept he’s written about: calculator fidelity. Understanding it is the first step in choosing...

The post The First Step to Choosing the Right Retirement Calculator appeared first on Can I Retire Yet?.

Are you setting a good example for your kid? Shouldn’t you work full-time at the office to support your family? What are you teaching your son by retiring early? These ... Read more

The post FIRE: The Greatest Gift for My Son appeared first on Retire by 40.

Are you setting a good example for your kid? Shouldn’t you work full-time at the office to support your family? What are you teaching your son by retiring early? These ... Read more

The post FIRE: The Greatest Gift for My Son appeared first on Retire by 40.

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page More Than Half of Americans Want to Retire Gradually , Ep 339 Posted by Benjamin Brandt Podcast 0 We all want to retire , but have you considered how you would like to transition to retirement This weekâ s retirement headline article shares some interesting statistics on phased retirements : who is thinking about them , who is utilizing them , and what people think about . them Listen in to learn the findings . Then stick around for our listener question surrounding stock positions , diversification , and . taxes Outline of This Episode 1:42 Exploring the idea of a phased retirement 7:12 Can a phased retirement allow

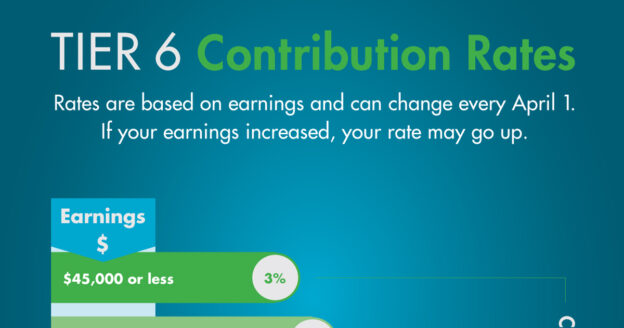

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page More Than Half of Americans Want to Retire Gradually , Ep 339 Posted by Benjamin Brandt Podcast 0 We all want to retire , but have you considered how you would like to transition to retirement This weekâ s retirement headline article shares some interesting statistics on phased retirements : who is thinking about them , who is utilizing them , and what people think about . them Listen in to learn the findings . Then stick around for our listener question surrounding stock positions , diversification , and . taxes Outline of This Episode 1:42 Exploring the idea of a phased retirement 7:12 Can a phased retirement allow Most NYSLRS members contribute a percentage of their earnings to help fund pension benefits. For Tier 6 members (those who joined NYSLRS on or after April 1, 2012), that percentage, or contribution rate, can change from year to year based on your earnings. The minimum rate is 3 percent of your earnings, and the maximum […]

Most NYSLRS members contribute a percentage of their earnings to help fund pension benefits. For Tier 6 members (those who joined NYSLRS on or after April 1, 2012), that percentage, or contribution rate, can change from year to year based on your earnings. The minimum rate is 3 percent of your earnings, and the maximum […] Member Annual Statements are distributed to NYSLRS members each spring. Don’t wait for a mailed copy — get your Statement online instead! You can update your delivery preference in Retirement Online to receive an email when your Statement is available. (Note: Retiree Annual Statements were made available online in February.) Get Your Member Annual Statement […]

Member Annual Statements are distributed to NYSLRS members each spring. Don’t wait for a mailed copy — get your Statement online instead! You can update your delivery preference in Retirement Online to receive an email when your Statement is available. (Note: Retiree Annual Statements were made available online in February.) Get Your Member Annual Statement […] Wow, I can’t believe it’s been 12 years since I left my engineering career! Time flies when you don’t have a boss. I’m happy to report I’m still going strong, ... Read more

The post 12 Years of Early Retirement appeared first on Retire by 40.

Wow, I can’t believe it’s been 12 years since I left my engineering career! Time flies when you don’t have a boss. I’m happy to report I’m still going strong, ... Read more

The post 12 Years of Early Retirement appeared first on Retire by 40.

Your retirement account can be an attractive target for scammers, and imposters continue to find new ways to try to impersonate government agencies, such as NYSLRS or the Social Security Administration. Learn to distinguish fake messages from official NYSLRS communications and protect yourself from scams. How Scams Work Imposters pretend to be an agency or […]

Your retirement account can be an attractive target for scammers, and imposters continue to find new ways to try to impersonate government agencies, such as NYSLRS or the Social Security Administration. Learn to distinguish fake messages from official NYSLRS communications and protect yourself from scams. How Scams Work Imposters pretend to be an agency or […] , About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page The Retirement Crisis That Wasnâ t , Ep 338 Posted by Benjamin Brandt Podcast 0 Once upon a time , there was a prediction that the baby boomer generation would face a retirement crisis . So how did this gloom and doom projection turn into the wealthiest generation in history Listen in to find . out Make sure to stay tuned for the listener question : What is the best way to fund a large expense without a large tax bill Outline of This Episode 1:37 The accuracy of predictions 7:26 What is the best way to fund a large expense without a large tax bill The dire consequences that didnâ t happen The baby boomers include

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page The Retirement Crisis That Wasnâ t , Ep 338 Posted by Benjamin Brandt Podcast 0 Once upon a time , there was a prediction that the baby boomer generation would face a retirement crisis . So how did this gloom and doom projection turn into the wealthiest generation in history Listen in to find . out Make sure to stay tuned for the listener question : What is the best way to fund a large expense without a large tax bill Outline of This Episode 1:37 The accuracy of predictions 7:26 What is the best way to fund a large expense without a large tax bill The dire consequences that didnâ t happen The baby boomers include