The Housing Crisis You Didn†t See Coming Ep 281 Retirement Starts Today Radio

Updated: 2023-01-30 14:14:02

As of January 1, 2023, when new members are enrolled in NYSLRS, they can choose “x” as their sex identification instead of “male” or “female.” Updating Your Sex Identification With NYSLRS If you’re already a member or a retiree, you can update your sex identification with us at any time. Sign in to Retirement Online […]

As of January 1, 2023, when new members are enrolled in NYSLRS, they can choose “x” as their sex identification instead of “male” or “female.” Updating Your Sex Identification With NYSLRS If you’re already a member or a retiree, you can update your sex identification with us at any time. Sign in to Retirement Online […] Whether you just joined or you’re a longtime member, you likely have questions about your NYSLRS membership. What is vesting? What are final average earnings? What tier are you in, and why does it even matter? Basic Concepts of NYSLRS Membership While NYSLRS administers many different retirement plans, the core concepts of our memberships are […]

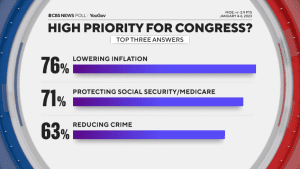

Whether you just joined or you’re a longtime member, you likely have questions about your NYSLRS membership. What is vesting? What are final average earnings? What tier are you in, and why does it even matter? Basic Concepts of NYSLRS Membership While NYSLRS administers many different retirement plans, the core concepts of our memberships are […] Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 17, 2023 House GOPâ s Plans to Cut

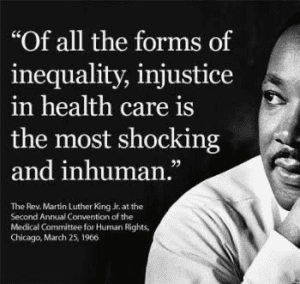

Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 17, 2023 House GOPâ s Plans to Cut . , . Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 13, 2023 Remembering Dr . Martin

. , . Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 13, 2023 Remembering Dr . Martin Your plan publication is an essential resource that you should consult throughout your career. It will help you plan for retirement and guide you when your retirement date draws near. Reminder: you can use this tool to help you find your retirement plan publication. Let’s explore the information you’ll find in your plan publication and […]

Your plan publication is an essential resource that you should consult throughout your career. It will help you plan for retirement and guide you when your retirement date draws near. Reminder: you can use this tool to help you find your retirement plan publication. Let’s explore the information you’ll find in your plan publication and […] Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 09, 2023 Pension Spending During Covid

Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 09, 2023 Pension Spending During Covid Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 09, 2023 Far-right House Members Seek

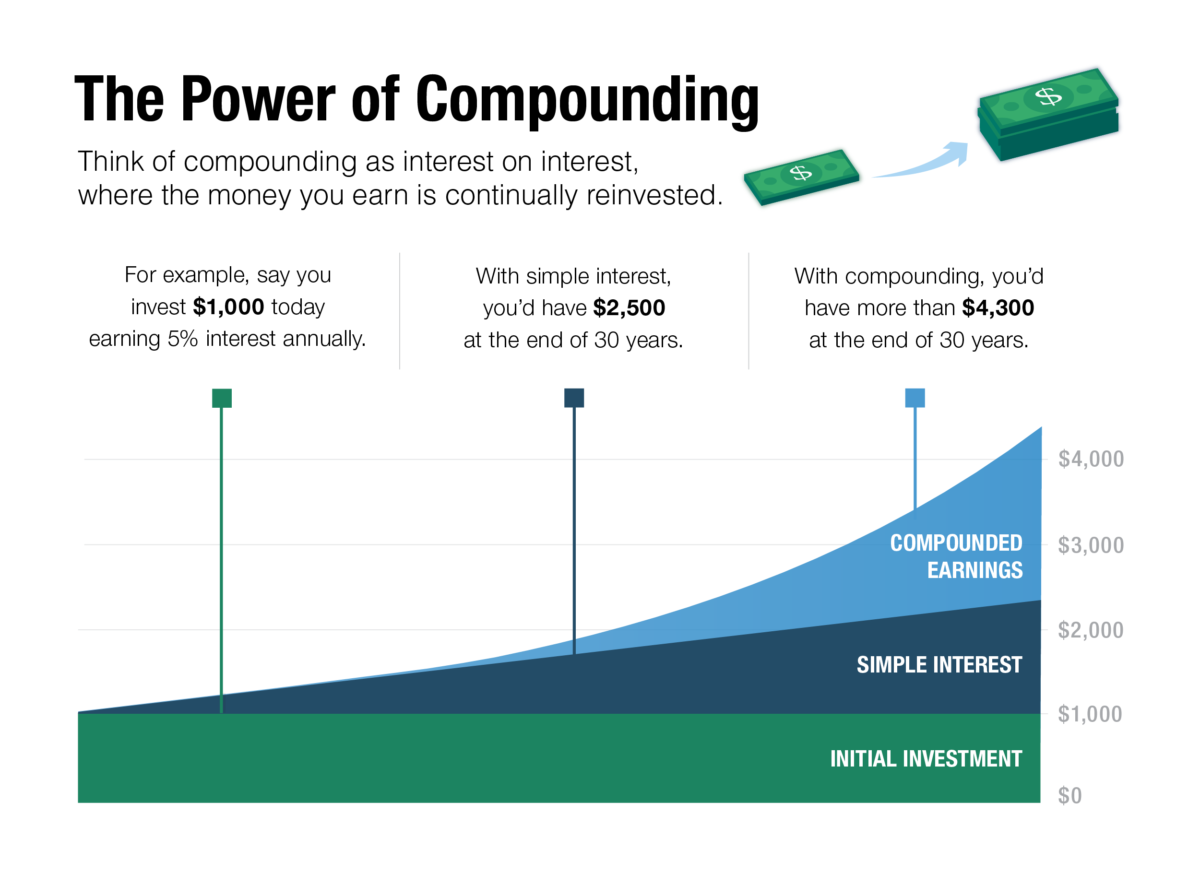

Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit January 09, 2023 Far-right House Members Seek Financial security doesn’t just happen; it takes planning … and time. If you want a financially secure retirement, it’s important to start saving and investing early so your money has time to grow. When you invest in a retirement savings plan such as an IRA or 457(b), you earn a return on your investment, and […]

Financial security doesn’t just happen; it takes planning … and time. If you want a financially secure retirement, it’s important to start saving and investing early so your money has time to grow. When you invest in a retirement savings plan such as an IRA or 457(b), you earn a return on your investment, and […]