KFF Health News: Biden Administration Sets Higher Staffing Mandates. Most Nursing Homes Don’t Meet Them.

Updated: 2024-04-25 18:39:02

: . . Blog en español Donate MENU Our Issues Fact Sheets and Position Papers Medicare Medicaid Affordable Care Act Pensions Social Security Prescription Drugs Resolutions Annual Congressional Voting Record Join Us State Alliances Alaska Arizona California Colorado Connecticut Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland District of Columbia Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Mexico New York North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Texas Vermont Virginia Washington West Virginia Wisconsin About Us Our Achievements Leadership Alliance Brochure Annual Activity Reports Sponsoring Unions CAN Mission Member Benefits Issue Toolkit April 25, 2024 KFF Health News : Biden

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page More Muscles Better Retirement , Ep 345 Posted by Benjamin Brandt Podcast 0 A lot of us are looking to get in shape in retirement . This is a good thing since part of living an even better retirement is looking after your health and muscle mass . Staying healthier and more active longer will ensure that you are making the most out of your retirement . In addition , maintaining a healthy muscle mass is a huge part of keeping your health as you . age In this episode , weâ ll explore a Scientific American article on keeping your muscles strong as you age . Make sure to listen in to discover some tools that I use to track

, About Blog Retirement Planning Social Security Investing Financial Planning Hiring A Financial Advisor General All Articles Podcast Ask A Question Work With Me Select Page More Muscles Better Retirement , Ep 345 Posted by Benjamin Brandt Podcast 0 A lot of us are looking to get in shape in retirement . This is a good thing since part of living an even better retirement is looking after your health and muscle mass . Staying healthier and more active longer will ensure that you are making the most out of your retirement . In addition , maintaining a healthy muscle mass is a huge part of keeping your health as you . age In this episode , weâ ll explore a Scientific American article on keeping your muscles strong as you age . Make sure to listen in to discover some tools that I use to track Did you know about 50% of Americans have a side hustle? That’s a staggering statistic, but not entirely surprising given the high cost of living. Many families are having a ... Read more

The post Are Side Hustles Worth It? appeared first on Retire by 40.

Did you know about 50% of Americans have a side hustle? That’s a staggering statistic, but not entirely surprising given the high cost of living. Many families are having a ... Read more

The post Are Side Hustles Worth It? appeared first on Retire by 40.

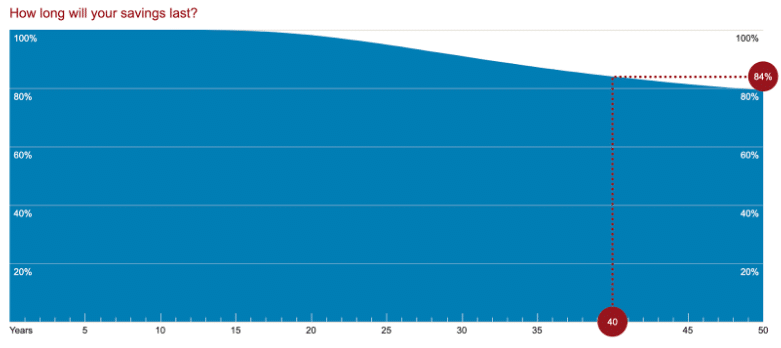

I recently reviewed the concept of retirement calculator fidelity. Retirement calculators vary considerably. They range from simple tools with a few inputs and outputs to advanced tools on par with professional financial planning software. As different as these tools are, they have one thing in common. Almost every retirement calculator gives you a measure of...

The post Defining Retirement Success and Failure appeared first on Can I Retire Yet?.

I recently reviewed the concept of retirement calculator fidelity. Retirement calculators vary considerably. They range from simple tools with a few inputs and outputs to advanced tools on par with professional financial planning software. As different as these tools are, they have one thing in common. Almost every retirement calculator gives you a measure of...

The post Defining Retirement Success and Failure appeared first on Can I Retire Yet?.

FIRE can be daunting when you’re starting out. When you’re young, you want to enjoy life and have fun. Saving for retirement is important, but it looks like a distant ... Read more

The post Is FIRE Out of Reach for Gen Z? appeared first on Retire by 40.

FIRE can be daunting when you’re starting out. When you’re young, you want to enjoy life and have fun. Saving for retirement is important, but it looks like a distant ... Read more

The post Is FIRE Out of Reach for Gen Z? appeared first on Retire by 40.

Here is an important retirement planning tip — most members can create their own pension estimate in minutes using Retirement Online. Your estimate will be based on the most up-to-date account information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit. When you’re done, you […]

Here is an important retirement planning tip — most members can create their own pension estimate in minutes using Retirement Online. Your estimate will be based on the most up-to-date account information we have on file for you. You can enter different retirement dates to see how those choices would affect your benefit. When you’re done, you […] What’s the surest way to become a millionaire? I can tell you right now – max out your 401k contribution every year. It will take a while, but I guarantee ... Read more

The post What if You Always Maxed Out Your 401k? appeared first on Retire by 40.

What’s the surest way to become a millionaire? I can tell you right now – max out your 401k contribution every year. It will take a while, but I guarantee ... Read more

The post What if You Always Maxed Out Your 401k? appeared first on Retire by 40.

April is National Financial Literacy Month, a time dedicated to helping people make informed financial decisions and manage money effectively. Financial literacy means understanding and using skills such as budgeting, investing and managing your personal finances. Greater financial literacy generally translates into greater financial well-being, according to a recent report from the TIAA Institute-GFLEC […]

April is National Financial Literacy Month, a time dedicated to helping people make informed financial decisions and manage money effectively. Financial literacy means understanding and using skills such as budgeting, investing and managing your personal finances. Greater financial literacy generally translates into greater financial well-being, according to a recent report from the TIAA Institute-GFLEC […]